With consumer spending weak, and demands upon social welfare budgets growing (rising unemployment etc...) most governments need to borrow money at the moment to simply be able to keep paying their bills. Today in the Autumn statement it has been announced that the UK will have to borrow significantly more than previously thought - something like £127bn this year... Actually that isn't too problematic for us. As the markets start to think that the UK is a fairly save investment the rate of interest that we need to pay on this borrowing is pretty low - perceived risk acting directly on the return (interest rate) that borrowers need to pay. The UK needs to pay just about 2.29% on new debt that it issues. For some context I pay about 3.5% on my mortgage, so quite reasonably the banks think that I am a riskier investment than the UK government is...

Now for the interesting bit. Italy has this morning needed to borrow £7.5bn in order to keep paying it's bills. It needed to pay a record breaking interest rate of 7.89%. This level of interest is simply unaffordable. And this is the crux of the current Eurozone crisis, and if it continues Europe will go into recession & given that it holds our biggest trading partners we will not be able to avoid following their path. So what should be done - ummmm no one really seems to have a satisfactory answer, each possible path is littered with huge pitfalls and more complex than can be explained here, the reality is however that a no action is probably the risky of all possible approaches! A grand solution is needed and before this is resolved all George Osborne can do is tinker at the edges, he is every bit as much a passenger as we are.

Tuesday, 29 November 2011

Monday, 7 November 2011

Have Best Buy got the best way revisited...

So on the 5th March this year I blogged on the likely fate of Best Buy in the UK commenting on the madness of their entry to the very developed and competitive market. Just what were they thinking??? In parallel with Tescos doomed entry to Japan (& US - watch this space) we have a large successful arrogant retailer that is entering a market without properly doing their homework. There was no space in the UK for Best Buy stores and the competition of Dixons et al. are pretty competent in seeing off the challenge.

So the inevitable has happened & Best Buy will close all of it's UK stores. The reasons they cite - "growth of product categories such as mobile phones and tablets" ok so why does this mean your stores fail??? "development of on-line retail" was that not predictable when you entered in 2008?? Finally "economic conditions" - here you might have a point, but given that they only entered in 2008 when the global crisis was in full swing this is not news and could have been realised a lot earlier.

This year the venture has lost £46.7m, last year £28.8m and in the previous years of capital investment surely similar figures and you build a picture of a lot of wasted money due to not doing your homework. I'd like to think that any of my international retailing students could have spotted the errors here & saved a couple of hundred million quid of ultimately pension fund money...

So the inevitable has happened & Best Buy will close all of it's UK stores. The reasons they cite - "growth of product categories such as mobile phones and tablets" ok so why does this mean your stores fail??? "development of on-line retail" was that not predictable when you entered in 2008?? Finally "economic conditions" - here you might have a point, but given that they only entered in 2008 when the global crisis was in full swing this is not news and could have been realised a lot earlier.

This year the venture has lost £46.7m, last year £28.8m and in the previous years of capital investment surely similar figures and you build a picture of a lot of wasted money due to not doing your homework. I'd like to think that any of my international retailing students could have spotted the errors here & saved a couple of hundred million quid of ultimately pension fund money...

Wednesday, 19 October 2011

Ok so we've done last orders - now surely it's time...

Today once again a really strikingly poor set of results from Argos. Like for Like sales are down 9.1% - that is huge. Below is my previous post from 9th June on their previous city update. Surely all of the points I made then are valid today. I maintain the view that there is no place in UK retail for the current Argos format and that a radical rethink is required. Ditch the printed catalogue to enable ranges and prices to far more flexible and offer swifter delivery pick ups would be a start. As it currently stands their profit levels represent a paltry return on their investment - they would be better off selling their assets and putting the money in the bank - less risk & a higher return!

Opinionated as always - but argue with me if you think this assessment is wrong!

9th June

Internet retailing has provided great opportunities and challenges to more traditional forms of retail commerce. Today's striking news that Argos' LFL sales are down some 9.6% surely will bring the company to fully examine their strategic options. Make no mistake, a 9.6% fall in sales is massive & even more difficult for a retailer such as Argos who cannot quickly flex their marketing to stimulate greater sales - after all their catalogue is printed with fixed prices etc...

For a long time I have thought that Argos has been too conservative in the face of a changing retail environment. E-commerce and the growth of supermarkets into non-food areas have introduced great challenges, but I believe also great opportunities for the company. What is it that Argos are great at?? They don't have a great product offer - that can be replicated by Tesco deliver or Amazon... Their real unique selling point lies in their ultra efficient store operations and selection of convenient locations around the UK. So how best to utilise this resource. Well in the face of growing e-commerce threat why not use these stores as collection hubs for the consumer - they could give their local store as their address and collect on a weekly basis all of their non-perishable on-line shopping. As a consumer there is nothing more annoying than to get home from work and find that three different couriers have tried to deliver packages & I now need to embark on a road trip to 3 different depots to collect my orders... far rather collated at a store of my choice with a simple customer focused collection method. This service could be free to the consumer with the on-line retailers giving Argos a cut and saving considerably on the otherwise increased courier costs. It does seem that there is a current gap in the market to better serve the on-line retailers and while the current Argos model is surely doomed in a few years they would be best placed to serve this new need. & while their at it what about an Argos drive through....

Opinionated as always - but argue with me if you think this assessment is wrong!

9th June

Internet retailing has provided great opportunities and challenges to more traditional forms of retail commerce. Today's striking news that Argos' LFL sales are down some 9.6% surely will bring the company to fully examine their strategic options. Make no mistake, a 9.6% fall in sales is massive & even more difficult for a retailer such as Argos who cannot quickly flex their marketing to stimulate greater sales - after all their catalogue is printed with fixed prices etc...

For a long time I have thought that Argos has been too conservative in the face of a changing retail environment. E-commerce and the growth of supermarkets into non-food areas have introduced great challenges, but I believe also great opportunities for the company. What is it that Argos are great at?? They don't have a great product offer - that can be replicated by Tesco deliver or Amazon... Their real unique selling point lies in their ultra efficient store operations and selection of convenient locations around the UK. So how best to utilise this resource. Well in the face of growing e-commerce threat why not use these stores as collection hubs for the consumer - they could give their local store as their address and collect on a weekly basis all of their non-perishable on-line shopping. As a consumer there is nothing more annoying than to get home from work and find that three different couriers have tried to deliver packages & I now need to embark on a road trip to 3 different depots to collect my orders... far rather collated at a store of my choice with a simple customer focused collection method. This service could be free to the consumer with the on-line retailers giving Argos a cut and saving considerably on the otherwise increased courier costs. It does seem that there is a current gap in the market to better serve the on-line retailers and while the current Argos model is surely doomed in a few years they would be best placed to serve this new need. & while their at it what about an Argos drive through....

Monday, 17 October 2011

Light in a dark place

So the economic news doesn't improve does it. We seem to constantly move from one crisis to the next with an ever increasing sense of eventual double recession or similar. Just last week the UK unemployment rate increased by some 100,000 to the highest level in 17 years. So we should all be really depressed right? No, we have chosen to study in surely the most dynamic of industries and one in which graduates are in very short supply and thus high demand. A week rarely goes by without at least one key retail company contacting me seeking good graduates to recruit, below is the latest from B&Q announcing a significant recruitment drive. Studying Retail Management is surely one of the best ways to ensure strong and varied grad job opportunities come economic rain or shine!

Retail Management Graduate Programme

Have you graduated with the last two years?

Do you know any recent graduates who are looking to kick start a fantastic career in retail?

Yesterday, Euan Sutherland announced the launch of our ambitious new Retail Management Graduate Programme at B&Q’s MPs reception held at the Houses of Parliament.

We are looking for graduates with a genuine passion for retail, people and leadership that want to build a foundation for their career where it all happens…in store!

The scheme is open to both internal and external candidates from the 10th October 2011 and an overview of the scheme can be viewed through the attached link.

Tuesday, 27 September 2011

Taking e-commerce to a new level...

Aurora fashions (Coast, Warehouse, Karen Millen & Oasis) are to extend their 90 minute delivery time across most of the UK after a successful trial within the M25... On the face of it doesn't that sound impressive - surf the net during your lunch break & have a new wardrobe of clothes delivered to the office before your afternoon tea break! But I wonder who really wants this? Surely the purchase of clothes is the most experiential of shopping - the touch, feel and 'real' look (i.e. not the pixelated 2D look) of the item being key. Aurora will only be able to offer this service close to existed stores & so it rather begs the question wouldn't you be better off popping out the shops yourself and getting the full experience. Oh & saving yourself the £9.99-£14.99 delivery charge to boot!

Wednesday, 31 August 2011

Tesco withdraws from Japan

Today's news that Tesco is seeking to sell it's Japanese chain and withdraw completely from the market should not be a great surprise. Japan has a highly developed retail sector with many established & highly competent chains - why would Tesco think that it could enter a market that it doesn't know, doesn't have any real logistical links to & is already full of good shops. Students will also be very familiar with the notion of 'Critical Mass' - where by you need a very significant chain of stores to contribute to the costs of building and employing the large warehouses and infrastructure to support stores - Tesco simply wasn't big enough in Japan to start with and then struggle to grow to a sufficient scale to become competitive.

So no big surprise that withdrawal has come, a sensible decision after an unwise investment - of course they will never disclose how many hundreds of millions they will have wasted in the process. How long till they give up on their equally misguided American venture??

So no big surprise that withdrawal has come, a sensible decision after an unwise investment - of course they will never disclose how many hundreds of millions they will have wasted in the process. How long till they give up on their equally misguided American venture??

Thursday, 25 August 2011

The opening of new markets

The internationalisation of retailers has not been a linear journey but rather witnessed big splurges of activity due to political and economic changes. One such change is just happening in India. Until now the Indian market has been almost closed to international retailers in a bid to protect businesses indigenous to the country, however such restrictions prevent the modernisation of the sector and can lead to inflationary pressures on consumer goods. A relaxation of the laws on foreign direct investment into the retail sector now looks likely & will lead to a wave of activity from the worlds largest retailers seeking expansion into the massive Indian market. Under the proposals, incoming retailers would be able to own 51% of any venture (i.e. a controlling stake), and will have to invest at least $100m, half of which will need to be invested into infrastructure that will benefit all retailers in the sector. They will only be able to operate multi-brand stores in cities with a population in excess of 1m. This really does represent a huge change in the attractiveness of the Indian market and a great opportunity for the likes of Tesco who desperately needs strong international sales given it's weak strategic position in the UK. For sure further liberalisation of the market will come in future years and so any investment now is likely to reap even greater opportunities in the future.

Friday, 19 August 2011

Cheer up consumers!

It's a long time since the financial chaos started in the Summer of 2008, however the effects will be felt for a long time yet. Nobody could have missed the riots over job losses and the continued national debt mounting & so it is timely to remember the critical role that the retail sector plays in all of this and the potential damage that the riots could inflict on all of our purses.

The logic runs like this. Consumer retail sales accounts for approximately one third of the entire economy of the country and represents a huge revenue flow for the government through all manner of taxes not least VAT. How much the consumer spends depends on a number of factors, though most significant is not their actual wealth but their perceived wealth & perception of the security of their wealth - i.e. feel good/bad factor. If consumers believe that the economy is struggling they may fear unemployment, consequently will cut back on their spending - collectively this will itself lead to the economy shrinking and redundancies being made - so a self fulfilling prophecy. Consumers will feel bad about their economic prospects in reaction to negative press stories of economic woes or wider negative stories such as the riots. In short the riots are likely to have the reverse effect of that sought by the trouble makers.

The logic runs like this. Consumer retail sales accounts for approximately one third of the entire economy of the country and represents a huge revenue flow for the government through all manner of taxes not least VAT. How much the consumer spends depends on a number of factors, though most significant is not their actual wealth but their perceived wealth & perception of the security of their wealth - i.e. feel good/bad factor. If consumers believe that the economy is struggling they may fear unemployment, consequently will cut back on their spending - collectively this will itself lead to the economy shrinking and redundancies being made - so a self fulfilling prophecy. Consumers will feel bad about their economic prospects in reaction to negative press stories of economic woes or wider negative stories such as the riots. In short the riots are likely to have the reverse effect of that sought by the trouble makers.

Friday, 1 July 2011

The internet scares me...

There is such a volume of material on the Internet, most of it of little interest or use, consequently while compiling some research this morning using a variety of different key words I found this...

I only vaguely remember doing this interview for a masters student so was surprised to find it loaded on the net. This snippet does however quite well summarises the research that I am currently working on, a small part of which has thus far been published in the Journal of Business Ethics with more to follow.

http://www.youtube.com/watch?v=pJrukFbUTeE

I only vaguely remember doing this interview for a masters student so was surprised to find it loaded on the net. This snippet does however quite well summarises the research that I am currently working on, a small part of which has thus far been published in the Journal of Business Ethics with more to follow.

http://www.youtube.com/watch?v=pJrukFbUTeE

Thursday, 9 June 2011

Volitility in the most stable of markets

International retailers need to be conscious of how a market could change affecting the viability of their operation. Tescos' operation in Thailand is an often used example of this given the significant threat to their Thai chain in the wake of the unexpected military coup in 2006. To the outsider Thailand appeared a very stable nation... And so we turn to what you might think to be one of the most stable countries in the world; America. Now I'm not suggesting a coup d'état in America; I'm pretty sure that is unthinkable, but talked about legal changes that would really threaten the viability of Tescos American operations. California is home to around 125 of 175 'Fresh and Easy' stores, and there is talk of an outright ban in the purchase of alcohol through self-service tills. Tesco installs self service tills exclusively as an essential part of it's low cost strategy. As the only grocer in the state to operate self-service tills it is clear that this law is specifically targeting the 'new kid on the block', and if it comes into effect will have a huge effect, forcing Tesco to rethink their strategy and presumably refitting their stores with at least some conventional cashier tills - all on top of a chain that is said to be underperforming and being challenged from a range of commentators. So in even the most stable of nations it is best to have a plan B.

Calling time on Argos??

Internet retailing has provided great opportunities and challenges to more traditional forms of retail commerce. Today's striking news that Argos' LFL sales are down some 9.6% surely will bring the company to fully examine their strategic options. Make no mistake, a 9.6% fall in sales is massive & even more difficult for a retailer such as Argos who cannot quickly flex their marketing to stimulate greater sales - after all their catalogue is printed with fixed prices etc...

For a long time I have thought that Argos has been too conservative in the face of a changing retail environment. E-commerce and the growth of supermarkets into non-food areas have introduced great challenges, but I believe also great opportunities for the company. What is it that Argos are great at?? They don't have a great product offer - that can be replicated by Tesco deliver or Amazon... Their real unique selling point lies in their ultra efficient store operations and selection of convenient locations around the UK. So how best to utilise this resource. Well in the face of growing e-commerce threat why not use these stores as collection hubs for the consumer - they could give their local store as their address and collect on a weekly basis all of their non-perishable on-line shopping. As a consumer there is nothing more annoying than to get home from work and find that three different couriers have tried to deliver packages & I now need to embark on a road trip to 3 different depots to collect my orders... far rather collated at a store of my choice with a simple customer focused collection method. This service could be free to the consumer with the on-line retailers giving Argos a cut and saving considerably on the otherwise increased courier costs. It does seem that there is a current gap in the market to better serve the on-line retailers and while the current Argos model is surely doomed in a few years they would be best placed to serve this new need. & while their at it what about an Argos drive through....

For a long time I have thought that Argos has been too conservative in the face of a changing retail environment. E-commerce and the growth of supermarkets into non-food areas have introduced great challenges, but I believe also great opportunities for the company. What is it that Argos are great at?? They don't have a great product offer - that can be replicated by Tesco deliver or Amazon... Their real unique selling point lies in their ultra efficient store operations and selection of convenient locations around the UK. So how best to utilise this resource. Well in the face of growing e-commerce threat why not use these stores as collection hubs for the consumer - they could give their local store as their address and collect on a weekly basis all of their non-perishable on-line shopping. As a consumer there is nothing more annoying than to get home from work and find that three different couriers have tried to deliver packages & I now need to embark on a road trip to 3 different depots to collect my orders... far rather collated at a store of my choice with a simple customer focused collection method. This service could be free to the consumer with the on-line retailers giving Argos a cut and saving considerably on the otherwise increased courier costs. It does seem that there is a current gap in the market to better serve the on-line retailers and while the current Argos model is surely doomed in a few years they would be best placed to serve this new need. & while their at it what about an Argos drive through....

Tuesday, 7 June 2011

1,155,347,700 customers are waiting

That's quite a big number & surely quite a big opportunity for the worlds largest retailers to chase. It is of course the population of India a retail market that has thus far been largely closed to international retailers due to protectionist laws preventing multi-brand retailers from holding a majority stake in retail ventures in the country. As we have seen gradually across the world such restrictive laws have been relaxed, and it seems that within months India will follow suit finally opening the market up to the likes of Tesco and Wal-Mart. Large scale investment into the Indian market by the likes of Tesco will not only provide a great opportunity for them, but the necessary investment in distribution infrastructure and change of retail culture will no doubt expose opportunities for a whole raft of international retailers.

Monday, 16 May 2011

Is Colin really a fashion icon?

Traditionally we have seen retailers internationalising from a highly developed retail market to a less well developed retail market... But as markets around the world are developing there are opportunities for innovative retailers from less developed retail markets to expand globally... One such retailer has come to my attention - Colin's clothing, nope no joke, Colin's clothing from Turkey has big ambitions including 100 stores in the UK. While a Turkish clothing retailer is well placed in terms of supply chain the big question here is - would you buy your clothes from Colin?!

Sunday, 8 May 2011

Tescos being 'Buffetted'

I have long commented on the questionable wisdom of Tesco entering the US. Given the choice of markets in across the globe, why would Tesco (the retailer that is ‘good’ but certainly not ‘unique’) enter the already crowded retail market of America – crowded actually with some very good grocery retailers of their own. It is very strongly my view that there are many countries in Asia particularly that hold far greater promise. What is also striking is their entry strategy, departing from their usual acquisition followed by growth, the enter with nothing and build up all the expensive infrastructure themselves – the expensive way. I have felt like a lone voice, but am reassured this week by the comments made by Warren Buffett (huge financier & speculator) which indicate that I am not alone. Buffett described Tescos US entry as ‘foolhardy’. Frankly I find it very hard to imagine a good business case for the US entry, and would not be surprised if they retreat loosing many millions of their investment in the process. Of course it could also be that I’m wrong and that Tescos make a success of it, but I would still maintain that there would have been better investment markets out there that would have provided a stronger short, medium & possibly even long term return.

Thursday, 5 May 2011

Focus on a variety store!

Focus the DIY chain with 178 stores has gone into administration. The chances of them being brought out of administration as a going concern are negligible I would imagine. They are simply too small to be able to compete with B&Q & Homebase. Frankly Wickes really appears to struggle to keep up as our third biggest DIY chain, and their stores are generally miserable affairs against the size and colour of a large B&Q. It is of course sad to see the demise of any retailer and the personal difficulties that it will mean for many employees, however it is an inevitable part of competition and it the current economic climate the weak are struggling – this year alone Oddbins, British Bookshop and Stationers & Allworths have folded & for sure there will be more before the year is out.

What is of note though is that as true as competition will lead to the demise of some retailers it will also allow others to flourish. I will never forget the media commentary at the time of Woolworths bankruptcy proclaiming the death of the variety store and how the format was no longer relevant in today’s society. What rubbish... Who was the retailer that bought all of MFIs stock when they closed their doors? And is now talking of taking on Focus’ stock and stores? Small independent chain The Range. They are, you might have guessed, a very flourishing variety store...

Limited Line Discounter growth

2008 saw growth in the sales of the Limited Line Discounters. The growth was widely attributed to the recession and weak consumer sentiment leading customers to seek cost reductions in their every day lives. There is no question that Aldi & Lidl are significantly cheaper than the mainstream competitors. The market share of Aldi & Lidl is still growing (currently 3.3% & 2.6% respectively), but not because they are attracting significantly new customers. Rather, those that tentatively (tentatively because frankly the stores are mostly a bit grim) dipped their metaphorical toes into a Lidl or Aldi store back in 2008 have actually found the products to be surprisingly good. This is of course good news for the discounters who have really struggled to communicate their strategy in the UK. They sell good stuff cheaply while the UK consumer assumes a strong correlation between price and quality and have assumed that the products are poor quality substitutes to the usual Tesco fare... With limited marketing budgets word of mouth is likely to form their best means for growing their customer base but before their market shares grow considerably when they can be really classed as 'mainstream' grocers they will have to improve their overall professionalism. Product availability has to be assured & mould vegetables on display just will not do!

Tuesday, 3 May 2011

M&S international expansion

The stated European expansion plans of M&S have come in for some scrutiny here previously, commenting on Marc Bollands aspiration to enter countries only where they can achieve a market leading presence. France? Really?!

And so it continues - it has now been announced that M&S will look to the Netherlands for their next European expansion. Has this decision been arrived at through careful scanning of European markets using objective measurement of each country against key criteria that are likely to be key importance for M&S. Or has it been made anecdotally given that Mr. Bolland is Dutch, has some market knowledge & has a lot of family over there?? I don't know but clearly have my suspicions. Given how easy it is to conduct thorough desk research on the attractiveness of countries it is amazing that it still appears to not be thoroughly done by some of our leading names - more on this theme & Tescos specifically to follow...

And so it continues - it has now been announced that M&S will look to the Netherlands for their next European expansion. Has this decision been arrived at through careful scanning of European markets using objective measurement of each country against key criteria that are likely to be key importance for M&S. Or has it been made anecdotally given that Mr. Bolland is Dutch, has some market knowledge & has a lot of family over there?? I don't know but clearly have my suspicions. Given how easy it is to conduct thorough desk research on the attractiveness of countries it is amazing that it still appears to not be thoroughly done by some of our leading names - more on this theme & Tescos specifically to follow...

Wednesday, 6 April 2011

The pain of commodity prices

Commodity prices are at historically sustained high levels & their effect is being felt on the whole global economy, but particularly sharply by a number of specific retailers. With Oil prices above $120 all costs are increasing, but it is the price of cotton that is currently the undoing of clothing firms with American Apparel the large US based chain issuing a new bankruptcy warning. Due largely to crop and soil fertility failure cotton prices are sustained at 200cent per pound, more than double their historic level. Consumers currently are simply not willing to accept these price rises being passed on leaving such retailers the very unhappy ‘piggies in the middle’. Maybe falling commodity prices will be just round the corner to ‘save their bacon’ – sorry ;)

Tuesday, 5 April 2011

Notworths

Much talk was made of how the British public no longer liked to shop at variety stores when Woolworths went out of business. At the time I was adamant that this was not the case and the media commentators had got it wrong. There are many current success's within UK variety retail, just look at Wilkinson & The Range. The real issue as I commented at the time is that Woolworths senior management was not strong enough. So it comes as no surprise that Alworths the company led by ex Woolworths director has also failed at the end of last week. With strong management variety store retail is flourishing in the UK. Woolworths had a strong brand and strong product mix both factors that have been rescued, but lets not try to rescue the management 'talent' that led to Woolworths original demise.

Sunday, 13 March 2011

Retail Internationalisation to Ireland...

Many writers have commented on the attraction of internationalising to similar markets first. Ireland must be a perfect target for UK retailers then. Culturally, Linguistically, Geographically proximate, and in the past 20 years slightly less economically developed meaning opportunities were present in the market for the ingressing retailer to capitalise on...

BUT - while Ireland was once the 'Celtic tiger' it is no more, it's huge financial difficulties commented on here previously have manifested themselves into 34 consecutive months of retail sales decline. So rapid are the sales declines that Carpetright is reporting drops in sales of some 50%, and announcing the closure of many stores. Birthdays have done the same, and I'm sure many others will follow. Just demonstrates once again the risks of any form of retail internationalisation even if you are taking the seemingly most cautious strategy.

BUT - while Ireland was once the 'Celtic tiger' it is no more, it's huge financial difficulties commented on here previously have manifested themselves into 34 consecutive months of retail sales decline. So rapid are the sales declines that Carpetright is reporting drops in sales of some 50%, and announcing the closure of many stores. Birthdays have done the same, and I'm sure many others will follow. Just demonstrates once again the risks of any form of retail internationalisation even if you are taking the seemingly most cautious strategy.

Saturday, 5 March 2011

Have Best Buy got the Best Way?

When a retailer becomes very strong in their home market they can become emboldened to believe that their format has great international appeal & move overseas. Best Buy is one such retailer, initially very slow to internationalise, then in recent years a lot of talk of their ambition including opening 80 large out of town stores in the UK. Quite why the UK market was chosen remains a mystery to me – it is a highly competitive market with large established players in the form of Dixons & Comet, and a market in which increasingly sales are moving to inevitably cheaper on-line retailers spearheaded by Amazon. So in the UK they have entered a competitive and shrinking market!

Just last week came the news that Best Buy will withdraw from 9 stores in China & their entire estate of 2 stores in Turkey. Does this represent a ‘failure’ in these markets, or the emergence of better investment opportunities? Given the scale of Best Buys resources I don’t think that these withdrawals will provide significant new sources of investment capital & so we have to put it down to returns in these stores not matching expectations – expectations presumably then that weren’t realistic or well enough researched? I do hope the UK market follows the same course, whatever happens given their slow start in the UK, the ambition for 80 stores now does not seem likely to be realised.

Thursday, 3 March 2011

Marks and Spencer returning to mainland Europe again...

Marks and Spencer had built up a significant business in mainland Europe, but in the 1990s when the brand was struggling to maintain is strong position in the UK is divested these operations. Now this withdrawal is widely considered to have been a mistake, and under Stuart Roses’ leadership M&S pursued international expansion again focusing on developing retail markets such as India & China, but now new head Marc Bolland has stated that he wishes to build ‘leadership positions’ in priority markets. This comes as it is widely tipped that M&S have secured the lease on the Esprit store the Champs-Elysees in Paris – I do hope that internationalisation is done carefully and in a fully researched manner rather than rather arrogantly assuming that their offer will be accepted largely without adaptation from the domestic offer. While a store in Paris could prove successful it does not appear to sit comfortably with Bollands vision – M&S will never be a fashion leader in the French market...

Wednesday, 2 March 2011

Online first international expansion

Zara have announced the launch of transactional web-sites in Denmark, Norway, Sweden, Monaco & Switzerland on March 3rd. This is an underused internationalisation strategy, to establish the brand in a country on-line and ‘test’ the markets acceptance of and interest in its products and approach. Most large retailers jump straight in with both feet with very significant capital investments setting up stores & very often making fundamental mistakes which either prove costly or fatal leading to market withdrawal. This cautious approach has a great deal of benefits – comparatively very low cost, potentially less damaging to the brand, provides a platform to learn the market and make necessary adjustments to the offer, and of course on-line customer feedback is embedded allowing the brand to really use their consumer and viewing non-consumers to help inform their practice.

Saturday, 26 February 2011

JJB & CVA

CVA's (Company Voluntary Arrangements) are a nice idea in principle: If a company has run out of cash and is staring bankrupcy in the face then rather than call in the administrators and shut up shop (in which event everyone looses generally), the company can negotiate a deal with it's creditors and subject to certain conditions continue to trade. JJB finds itself in this position for the second time in two years and is seeking a CVA agreement with it's creditors - most notably it's landlords. The proposed CVA is likely to release JJB from some long leases signed on retail premisis, and allow for some rent reductions on others - the assumption is that the landlord should be happy with some rent rather than the alternative of none at all.

But, the fragile state of JJB has been the subject of comment on here previously. It's competitors are performing well, but yet JJB has repeatedly sought further support from the banks and it's shareholders. When will the support stop and people realise that this is simply a fundementally poorly run business and pull the plug. With two CVA's in two years there are some real issues around fairness of competition. JJB is able to downwardly negotiate rents and get out of contracts that it willingly entered into while it's competitors who have managed their businesses with greater competance have no such advantage... Fair competition??

But, the fragile state of JJB has been the subject of comment on here previously. It's competitors are performing well, but yet JJB has repeatedly sought further support from the banks and it's shareholders. When will the support stop and people realise that this is simply a fundementally poorly run business and pull the plug. With two CVA's in two years there are some real issues around fairness of competition. JJB is able to downwardly negotiate rents and get out of contracts that it willingly entered into while it's competitors who have managed their businesses with greater competance have no such advantage... Fair competition??

Monday, 31 January 2011

Bad News...

It seems that we are only getting bad news about the retail sector and the economy in general this year so far. There are many issues that could be commented on, but today it is notable that the price of oil has breached $100 a barrel for the first time since 2008. This is bad news as oil prices filter through to the price of everything in the shops and thus retail inflation. If you consider for a moment the impact that this slightly raised inflation could have on our economy - already two members of the Bank of England Monetary Policy Committee are voting for an interest rate rise, with increased inflation, just by a little bit others may vote in this direction also resulting in a rise that really could damage our economic outlook. A rise in interest rates as we know will mean less money generally in the economy, probably falling house prices and yet lower consumer confidence.

Now lets look at the reason for the 'mini' spike in oil prices today: The only story in the news today seemingly, the crisis in Egypt. 5% of the worlds oil travels through the Suez canal to reach it's final destination and speculators are worried that the current turmoil in the country could disrupt this important passage, thus the price rise. So protesters in Egypt really do threaten to have an effect on the UK economy!

Now lets look at the reason for the 'mini' spike in oil prices today: The only story in the news today seemingly, the crisis in Egypt. 5% of the worlds oil travels through the Suez canal to reach it's final destination and speculators are worried that the current turmoil in the country could disrupt this important passage, thus the price rise. So protesters in Egypt really do threaten to have an effect on the UK economy!

Thursday, 27 January 2011

New insights into ethical consumption, or the lack of it...

Mostly my research focuses on the role of ethics in consumer decision making. This has formed my doctoral studies for the last 4 years or so which hopefully will be concluded this year, & will lead to a number of publications. The first significant output is the following paper that has been available on-line for a couple of months, but only today has 'gone to print'. It really does provide fresh insight into why consumers say that they care about ethics but actually rarely buy ethical products. This is called the 30:3 phenomenon with 30% of consumers saying that they care, but ethical lines such as fair trade coffee rarely achieving market shares of greater than 3%. The research presented here provides some insights into the reasons why these good intentions are not converted.

Bray, J., Johns, N. and Kilburn, D. (2011) An exploratory study into the factors impeding ethical consumption. Journal of Business Ethics. 98 (4): 597-618

Thursday, 13 January 2011

If only oil would follow gravity - down...

Oil prices are in the news again causing a real conundrum for economists and the Bank of England (BOE).

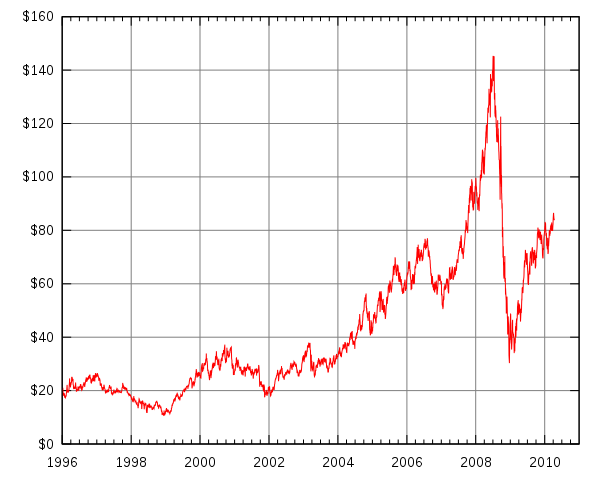

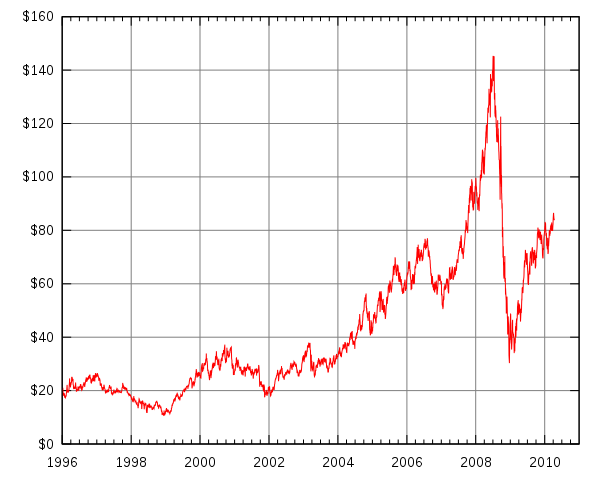

Yesterday on schedule the BOE monetary policy committee met to discuss interest rates & today at noon their decision was announced. No big surprises - interest rates held at 0.5% for another month, and no quantitative easing for now. Their big headache though is that their key task is to keep inflation down & for over 12months inflation has been running at over 1% more than their 2% target. So really they should be putting interest rates up to try to reduce demand and thus inflation. But with oil prices at such high levels historically (just take a look at the graph below - it's a little out of date & today we're basically at $100 - just a couple of years ago oil was about $20 a barrel, now $100 and rising), that affects the costs of producing nearly everything & the cost of transporting everything. So inflation is high not because of too much demand, but because of costs rising...

If retail price inflation is running at around 5% and people are on near pay freezes clearly the amount of goods being purchased will be falling and this is really bad news for the economy and the pace of recovery from recession, but trying to reduce inflation by putting interest rates up would make mortgages unaffordable to many of these same people leading to further house price crash & repossessions. I can't help thinking that there is a big house of cards forming again and we could have some really dramatic global economic trouble in the next two years if oil prices and other commodity prices don't fall taking inflation with it.

Yesterday on schedule the BOE monetary policy committee met to discuss interest rates & today at noon their decision was announced. No big surprises - interest rates held at 0.5% for another month, and no quantitative easing for now. Their big headache though is that their key task is to keep inflation down & for over 12months inflation has been running at over 1% more than their 2% target. So really they should be putting interest rates up to try to reduce demand and thus inflation. But with oil prices at such high levels historically (just take a look at the graph below - it's a little out of date & today we're basically at $100 - just a couple of years ago oil was about $20 a barrel, now $100 and rising), that affects the costs of producing nearly everything & the cost of transporting everything. So inflation is high not because of too much demand, but because of costs rising...

If retail price inflation is running at around 5% and people are on near pay freezes clearly the amount of goods being purchased will be falling and this is really bad news for the economy and the pace of recovery from recession, but trying to reduce inflation by putting interest rates up would make mortgages unaffordable to many of these same people leading to further house price crash & repossessions. I can't help thinking that there is a big house of cards forming again and we could have some really dramatic global economic trouble in the next two years if oil prices and other commodity prices don't fall taking inflation with it.

Monday, 10 January 2011

Portugals January Sale

On Wednesday Portugal is going to try to raise 1.25bn Euro by auctioning off government debt - selling bonds. This is perfectly normal practice and certainly we have had to do a lot of it to fund our deficit in recent years.

The interesting point though has been commented here before, but worth an update. Current bond yields on 10year Portuguese debt is 7.16% i.e. they need to offer a 7.16% rate of interest to sell their debt. Compare this to Germany's rate of 2.87% or our current rate of 3.52% - a little maths will show that Portugal will pay 0.895bn in interest on this debt sale over it's life, where Germany would pay 0.036bn and UK 0.044bn.

Portugal have to offer a higher rate of interest as they are perceived to be higher risk, but the problem is that the higher rate of interest itself could be just the trigger that prevents their economy from coping & of course if they can't cope then they will have to go the same way as Greece and Ireland in taking a loan from the EU/IMF that will come with some very unattractive terms. And then you have the bigger question - how much cash does the EU & IMF have to lend. If Portugal needs a load of money on top of recent big spends, they would be near out of money, and then if Spain needed help.... Not sure where that would leave us - certainly a global crisis to match that of 2008 - and the consequent pain that we are all experiencing as a consequence of that.

The interesting point though has been commented here before, but worth an update. Current bond yields on 10year Portuguese debt is 7.16% i.e. they need to offer a 7.16% rate of interest to sell their debt. Compare this to Germany's rate of 2.87% or our current rate of 3.52% - a little maths will show that Portugal will pay 0.895bn in interest on this debt sale over it's life, where Germany would pay 0.036bn and UK 0.044bn.

Portugal have to offer a higher rate of interest as they are perceived to be higher risk, but the problem is that the higher rate of interest itself could be just the trigger that prevents their economy from coping & of course if they can't cope then they will have to go the same way as Greece and Ireland in taking a loan from the EU/IMF that will come with some very unattractive terms. And then you have the bigger question - how much cash does the EU & IMF have to lend. If Portugal needs a load of money on top of recent big spends, they would be near out of money, and then if Spain needed help.... Not sure where that would leave us - certainly a global crisis to match that of 2008 - and the consequent pain that we are all experiencing as a consequence of that.

M-Commerce

It seems I've been quite slow to grasp this whole smart phone thing... There have been a flurry of recent stories on the predicted growth of M-commerce with companies investing millions into mobile optimised transactional sites. I have even last night seen a Tesco iPhone advert launching their new bar coding app. Now I can see the appeal of a phone where you could using the camera scan a bar code & then without any further input that product is delivered to your door, but really full scale shopping on a tiny mobile handset will surely never take off. You can't see the products properly, you need nail extensions to be able press the tiny keys (I've not tried this but imagine that they could be a helpful addition in this regard rather than my stumpy digits that type ghj for every h wanted - I'm not awfully keen on nail extensions though...).

But I fear that I might just be a little out of touch here and that there is another generation that have grown up with web-enabled phones and are used to this highly compromised shopping experience. Can I ask for comments here, have you ever bought through m-commerce & what.

Thanks,

But I fear that I might just be a little out of touch here and that there is another generation that have grown up with web-enabled phones and are used to this highly compromised shopping experience. Can I ask for comments here, have you ever bought through m-commerce & what.

Thanks,

That's snow excuse!

Sorry, I shouldn't try humour... So far just a 'flurry' of companies have come out and discussed their Christmas performances - JJB, Mothercare, Next & HMV were all quick to press announcing poor sales and squarely laying the blame on the bad December weather - on the surface of it these tales of difficult weather are quite easy to believe, but while JJB is reporting snow affected sales JD Sports has delivered strong like for like sales growth, and today independent figures of retail trade are released showing just a modest 0.5% fall in December sales.

With fascias such as JD Sports delivering strong growth and JJB falling sales clearly there is something more than just snow fall going on. What tends to happen in a period of challenge is that the strong get stronger and the weak struggle and ultimately might fail. This Christmas, and for much of 2011 there will be many challenges and undoubtedly some firms will fail, but lets not pretend it is the white stuff causing it - ultimately it is sub-standard management at the very top.

With fascias such as JD Sports delivering strong growth and JJB falling sales clearly there is something more than just snow fall going on. What tends to happen in a period of challenge is that the strong get stronger and the weak struggle and ultimately might fail. This Christmas, and for much of 2011 there will be many challenges and undoubtedly some firms will fail, but lets not pretend it is the white stuff causing it - ultimately it is sub-standard management at the very top.

Subscribe to:

Comments (Atom)