It seems that we are only getting bad news about the retail sector and the economy in general this year so far. There are many issues that could be commented on, but today it is notable that the price of oil has breached $100 a barrel for the first time since 2008. This is bad news as oil prices filter through to the price of everything in the shops and thus retail inflation. If you consider for a moment the impact that this slightly raised inflation could have on our economy - already two members of the Bank of England Monetary Policy Committee are voting for an interest rate rise, with increased inflation, just by a little bit others may vote in this direction also resulting in a rise that really could damage our economic outlook. A rise in interest rates as we know will mean less money generally in the economy, probably falling house prices and yet lower consumer confidence.

Now lets look at the reason for the 'mini' spike in oil prices today: The only story in the news today seemingly, the crisis in Egypt. 5% of the worlds oil travels through the Suez canal to reach it's final destination and speculators are worried that the current turmoil in the country could disrupt this important passage, thus the price rise. So protesters in Egypt really do threaten to have an effect on the UK economy!

Monday 31 January 2011

Thursday 27 January 2011

New insights into ethical consumption, or the lack of it...

Mostly my research focuses on the role of ethics in consumer decision making. This has formed my doctoral studies for the last 4 years or so which hopefully will be concluded this year, & will lead to a number of publications. The first significant output is the following paper that has been available on-line for a couple of months, but only today has 'gone to print'. It really does provide fresh insight into why consumers say that they care about ethics but actually rarely buy ethical products. This is called the 30:3 phenomenon with 30% of consumers saying that they care, but ethical lines such as fair trade coffee rarely achieving market shares of greater than 3%. The research presented here provides some insights into the reasons why these good intentions are not converted.

Bray, J., Johns, N. and Kilburn, D. (2011) An exploratory study into the factors impeding ethical consumption. Journal of Business Ethics. 98 (4): 597-618

Thursday 13 January 2011

If only oil would follow gravity - down...

Oil prices are in the news again causing a real conundrum for economists and the Bank of England (BOE).

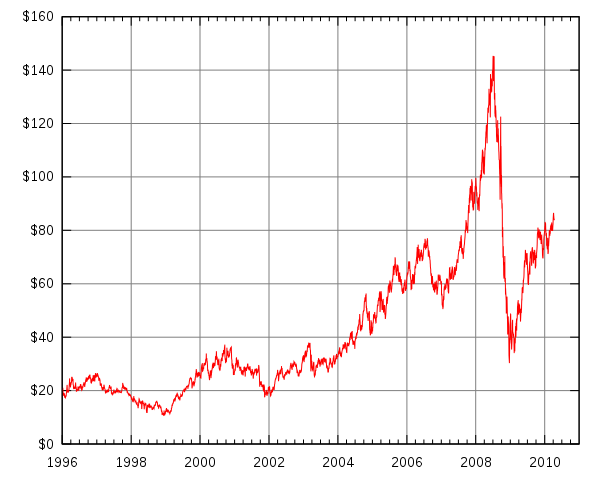

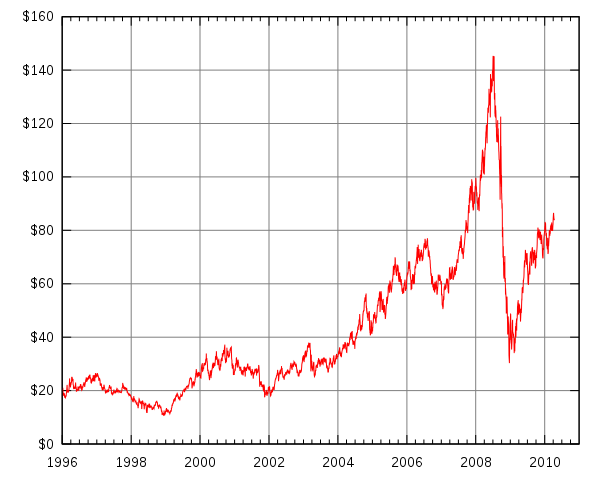

Yesterday on schedule the BOE monetary policy committee met to discuss interest rates & today at noon their decision was announced. No big surprises - interest rates held at 0.5% for another month, and no quantitative easing for now. Their big headache though is that their key task is to keep inflation down & for over 12months inflation has been running at over 1% more than their 2% target. So really they should be putting interest rates up to try to reduce demand and thus inflation. But with oil prices at such high levels historically (just take a look at the graph below - it's a little out of date & today we're basically at $100 - just a couple of years ago oil was about $20 a barrel, now $100 and rising), that affects the costs of producing nearly everything & the cost of transporting everything. So inflation is high not because of too much demand, but because of costs rising...

If retail price inflation is running at around 5% and people are on near pay freezes clearly the amount of goods being purchased will be falling and this is really bad news for the economy and the pace of recovery from recession, but trying to reduce inflation by putting interest rates up would make mortgages unaffordable to many of these same people leading to further house price crash & repossessions. I can't help thinking that there is a big house of cards forming again and we could have some really dramatic global economic trouble in the next two years if oil prices and other commodity prices don't fall taking inflation with it.

Yesterday on schedule the BOE monetary policy committee met to discuss interest rates & today at noon their decision was announced. No big surprises - interest rates held at 0.5% for another month, and no quantitative easing for now. Their big headache though is that their key task is to keep inflation down & for over 12months inflation has been running at over 1% more than their 2% target. So really they should be putting interest rates up to try to reduce demand and thus inflation. But with oil prices at such high levels historically (just take a look at the graph below - it's a little out of date & today we're basically at $100 - just a couple of years ago oil was about $20 a barrel, now $100 and rising), that affects the costs of producing nearly everything & the cost of transporting everything. So inflation is high not because of too much demand, but because of costs rising...

If retail price inflation is running at around 5% and people are on near pay freezes clearly the amount of goods being purchased will be falling and this is really bad news for the economy and the pace of recovery from recession, but trying to reduce inflation by putting interest rates up would make mortgages unaffordable to many of these same people leading to further house price crash & repossessions. I can't help thinking that there is a big house of cards forming again and we could have some really dramatic global economic trouble in the next two years if oil prices and other commodity prices don't fall taking inflation with it.

Monday 10 January 2011

Portugals January Sale

On Wednesday Portugal is going to try to raise 1.25bn Euro by auctioning off government debt - selling bonds. This is perfectly normal practice and certainly we have had to do a lot of it to fund our deficit in recent years.

The interesting point though has been commented here before, but worth an update. Current bond yields on 10year Portuguese debt is 7.16% i.e. they need to offer a 7.16% rate of interest to sell their debt. Compare this to Germany's rate of 2.87% or our current rate of 3.52% - a little maths will show that Portugal will pay 0.895bn in interest on this debt sale over it's life, where Germany would pay 0.036bn and UK 0.044bn.

Portugal have to offer a higher rate of interest as they are perceived to be higher risk, but the problem is that the higher rate of interest itself could be just the trigger that prevents their economy from coping & of course if they can't cope then they will have to go the same way as Greece and Ireland in taking a loan from the EU/IMF that will come with some very unattractive terms. And then you have the bigger question - how much cash does the EU & IMF have to lend. If Portugal needs a load of money on top of recent big spends, they would be near out of money, and then if Spain needed help.... Not sure where that would leave us - certainly a global crisis to match that of 2008 - and the consequent pain that we are all experiencing as a consequence of that.

The interesting point though has been commented here before, but worth an update. Current bond yields on 10year Portuguese debt is 7.16% i.e. they need to offer a 7.16% rate of interest to sell their debt. Compare this to Germany's rate of 2.87% or our current rate of 3.52% - a little maths will show that Portugal will pay 0.895bn in interest on this debt sale over it's life, where Germany would pay 0.036bn and UK 0.044bn.

Portugal have to offer a higher rate of interest as they are perceived to be higher risk, but the problem is that the higher rate of interest itself could be just the trigger that prevents their economy from coping & of course if they can't cope then they will have to go the same way as Greece and Ireland in taking a loan from the EU/IMF that will come with some very unattractive terms. And then you have the bigger question - how much cash does the EU & IMF have to lend. If Portugal needs a load of money on top of recent big spends, they would be near out of money, and then if Spain needed help.... Not sure where that would leave us - certainly a global crisis to match that of 2008 - and the consequent pain that we are all experiencing as a consequence of that.

M-Commerce

It seems I've been quite slow to grasp this whole smart phone thing... There have been a flurry of recent stories on the predicted growth of M-commerce with companies investing millions into mobile optimised transactional sites. I have even last night seen a Tesco iPhone advert launching their new bar coding app. Now I can see the appeal of a phone where you could using the camera scan a bar code & then without any further input that product is delivered to your door, but really full scale shopping on a tiny mobile handset will surely never take off. You can't see the products properly, you need nail extensions to be able press the tiny keys (I've not tried this but imagine that they could be a helpful addition in this regard rather than my stumpy digits that type ghj for every h wanted - I'm not awfully keen on nail extensions though...).

But I fear that I might just be a little out of touch here and that there is another generation that have grown up with web-enabled phones and are used to this highly compromised shopping experience. Can I ask for comments here, have you ever bought through m-commerce & what.

Thanks,

But I fear that I might just be a little out of touch here and that there is another generation that have grown up with web-enabled phones and are used to this highly compromised shopping experience. Can I ask for comments here, have you ever bought through m-commerce & what.

Thanks,

That's snow excuse!

Sorry, I shouldn't try humour... So far just a 'flurry' of companies have come out and discussed their Christmas performances - JJB, Mothercare, Next & HMV were all quick to press announcing poor sales and squarely laying the blame on the bad December weather - on the surface of it these tales of difficult weather are quite easy to believe, but while JJB is reporting snow affected sales JD Sports has delivered strong like for like sales growth, and today independent figures of retail trade are released showing just a modest 0.5% fall in December sales.

With fascias such as JD Sports delivering strong growth and JJB falling sales clearly there is something more than just snow fall going on. What tends to happen in a period of challenge is that the strong get stronger and the weak struggle and ultimately might fail. This Christmas, and for much of 2011 there will be many challenges and undoubtedly some firms will fail, but lets not pretend it is the white stuff causing it - ultimately it is sub-standard management at the very top.

With fascias such as JD Sports delivering strong growth and JJB falling sales clearly there is something more than just snow fall going on. What tends to happen in a period of challenge is that the strong get stronger and the weak struggle and ultimately might fail. This Christmas, and for much of 2011 there will be many challenges and undoubtedly some firms will fail, but lets not pretend it is the white stuff causing it - ultimately it is sub-standard management at the very top.

Subscribe to:

Posts (Atom)